Road to The Richer Life

Our relationship with International Money Matters is since its inception. We have grown with it and so has our modest savings. IMMPL's smart financial plans keep us focused on regular savings. Their wisdom to think long term goes hand-in-hand with their adaptability towards market trends.

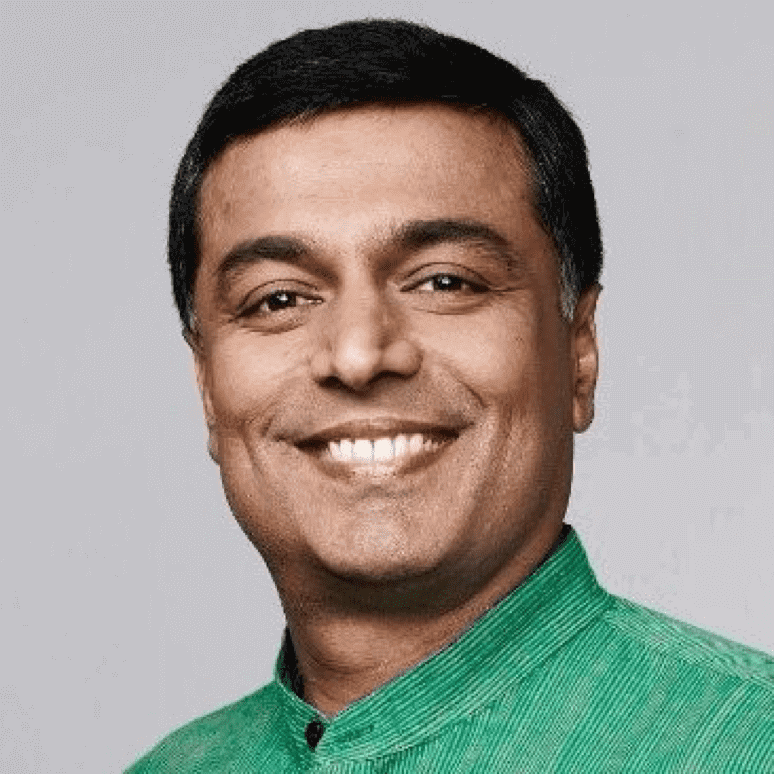

Sunil Lulla

Group Chief Executive Office , Balaji Telefilms Ltd.

IMMPL ensured that I was able to articulate and achieve my financial goals. The team at IMMPL embodies professionalism, empathy, friendship and trust. I thank them for all that they have done and continue to do for me.All the awards and industry recognition they receive are well-deserved.

Mr. C.E. Sridhar

Consultant - Process Improvement & People

I find their advice sound and am happy to rely on them to ensure that I am financially secure! To be honest, there were occasions when I had some doubts and concerns, especially when markets swing downwards but the folks at IMMPL have provided more than adequate reassurances that they care for my financial health.

Dr. Anand Kasturi

Consultant Trainer, Executive Coach

My relationship with IMMPL began 5 years ago. Lovaii was a friend and took a personal interest in managing my portfolio. While that has remained, I have been impressed by the caliber of the team he has built: young, knowledgeable and diligent. They put the client's interest first.

Mr. Vijay Bhat

Transitions Coach, Roots & Wings Consulting Services Pvt. Ltd.